Before you smile at your next salary alert, pause for one minute.

Because what you’re about to read is the exact reason millions of Nigerians are already paying tax twice, losing money silently, and they don’t even know it.

If you’ve ever collected salary, bonus, commission, or allowance in Nigeria…

Don’t scroll.

This one is for you.

Most Read Post: How to Pay Zero Tax in Nigeria 2026

The Question From Mr. Adedayo That Exposed a Big Nigerian Tax Problem

After a previous post on taxation, someone sent this message:

“Mr Adedayo, my company already deducts tax from my bonus automatically. Do I still need to submit my TIN?”

It sounds simple…

But this single question is the reason so many Nigerians will enter 2026 with tax wahala they could have avoided.

Let’s break it down in plain English, the way even a grandma in the village will understand.

Salary Tax Is Normal But That’s Not the Real Issue

Yes, when your company pays you a salary or bonus, the government deducts tax automatically.

That part is correct.

That part is legal.

But the problem begins when your tax identity is not properly aligned.

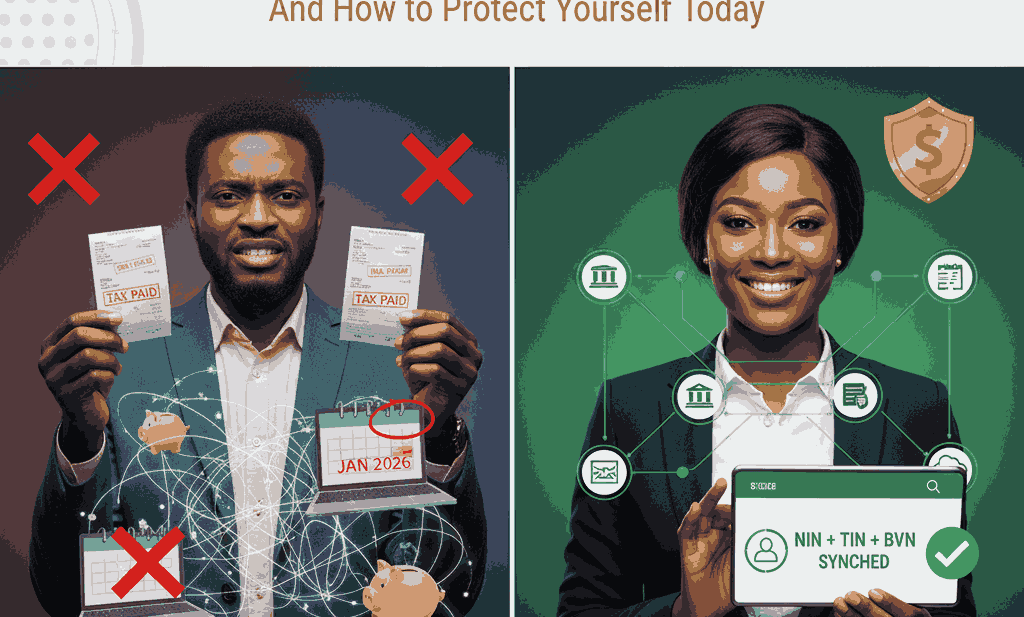

And with the 2026 Progressive Tax Era coming, an unaligned identity will cause issues like:

- paying tax twice

- wrong tax deductions

- missing tax records

- failed verification

- tax clearance problems

- penalties for “unregistered taxpayer.”

- inability to claim refunds

All because your identity doesn’t match across systems.

The Tax Identity Crisis: Why Nigerians Look Like 5 Different People in the System

Here’s the truth:

Most Nigerians have one salary…

But five different identities in the tax system.

The system may see:

- Salary Adedayo

- Bonus Adedayo

- BVN Adedayo

- Business Adedayo

- Zero-TIN Adedayo

And once your identity is scattered across different databases, the FIRS system can’t match your tax deductions to your name.

Meaning:

You may be paying, but the system still sees “No tax record found.”

You Might Have Missed This: Nigeria Tax Reform January 1, 2026

Why Automatic Deduction Doesn’t Mean You’re Safe

Many people think:

“Since they deduct tax from my salary automatically, I’m good.”

No, you’re not.

Automatic deduction does NOT guarantee:

- Your tax profile is correct

- Your identity is synchronized

- Your TIN is active

- Your records are attached to your name

- Your tax history is clean

- Your 2026 tax file exists

This is how HR can deduct your tax for 10 years…

Yet FIRS will tell you:

“You are owing.”

The 2026 Digital Tax System Will Shock Many Nigerians

From January 1st, 2026, FIRS will introduce a new unified database.

Every:

- worker

- business owner

- freelancer

- side hustler

- salary earner

- bonus recipient

…must have one verified TIN linked to NIN and BVN.

If you don’t submit your TIN to your employer before then:

They will deduct your tax…

But it won’t enter your name.

Meaning:

You will pay tax to nobody.

And during verification?

“You have no tax record.”

“You are owing.”

“Your history is incomplete.”

Even if they’ve deducted tax from you every month since 2010.

The Simple Formula Every Nigerian Must Follow Before 2026

To avoid double taxation and confusion:

✔ Submit your TIN to your employer

✔ Use ONE TIN for salary, bonus, and business

✔ Ensure your NIN matches your bank account name

✔ Sync BVN + NIN + TIN + payroll

✔ Fix mismatched tax records immediately

This is how smart people avoid stress.

How Rexobe Consult Helps You Fix This Before 2026 Hits

Most Nigerians won’t know their tax identity is scattered until:

- Their tax clearance is blocked

- They can’t renew documents

- They are flagged in the new system

- They need refunds

- Salary deductions don’t reflect

Rexobe Consult helps you:

- Fix double taxation

- Correct NIN/TIN/BVN mismatches

- Sync payroll and tax identity

- Recover missing tax records

- Prepare for the 2026 FIRS system update

- Streamline business and salary taxes

Don’t wait until Nigeria enters the new tax era and you become a victim of confusion.

Office Address:

B3 Suite 13 FF, Abisco Lane,

Rauf Aregbesola Shopping Complex,

Ipaja Road, Lagos State.

WhatsApp: https://wa.me/2348063830956

Website: rexobeconsult.com

Instagram: @rexobeconsult